Should Entrepreneurs Use Brexit as a Springboard?

As homo sapiens we’re more or less hard-wired to respond negatively to change. When big shake-ups occur, most of us are more likely to hide under the blanket than leap boldly into the unknown.

Faced with the uncertainty surrounding Brexit, many UK businesses and entrepreneurs are playing a cagey game, holding off on big moves until the UK’s future business landscape becomes clear. But it doesn’t have to be this way…

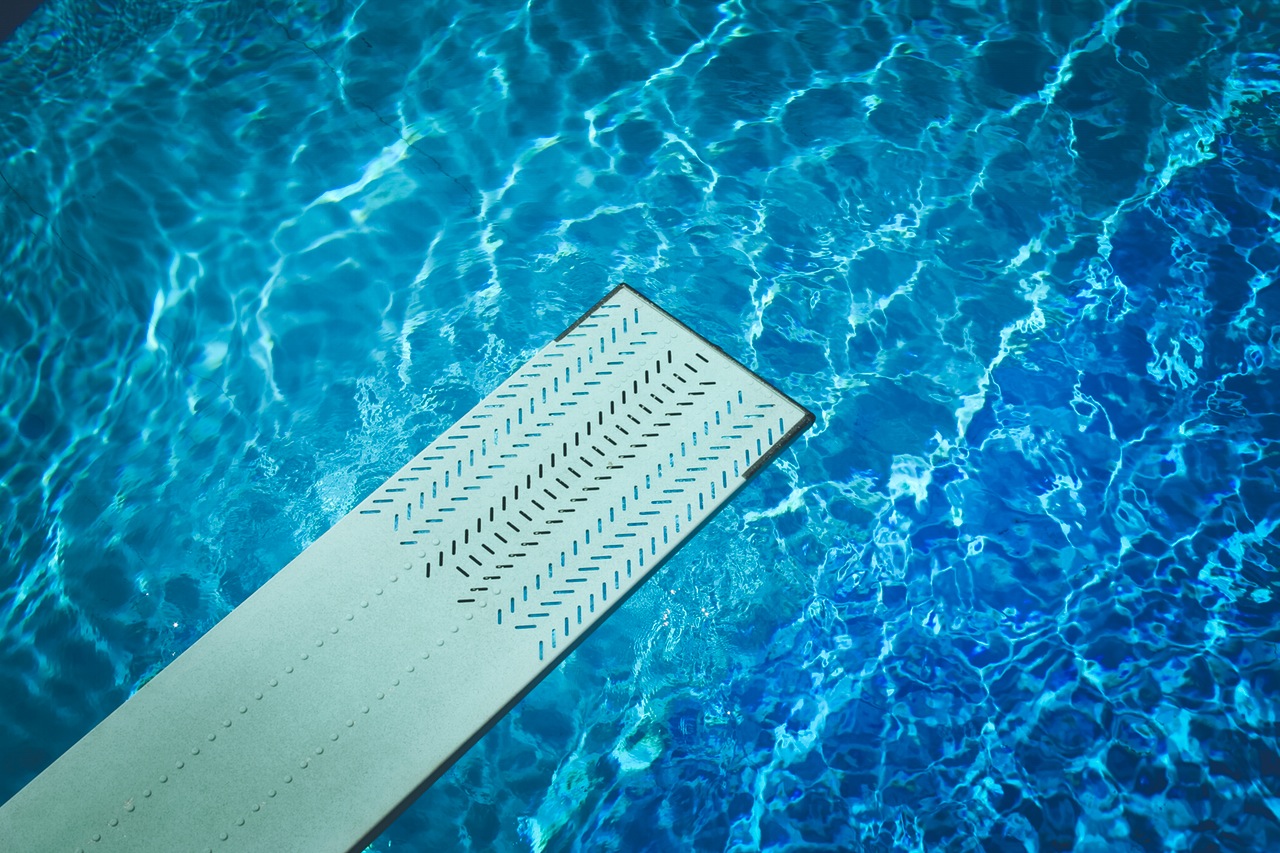

What if, rather than hiding until the tumult is over, British businesses and bright sparks used this exciting moment in UK history as an opportunity to really make their mark? While the majority clam up and “hibernate” until the uncertainty ends, right now could well be a great time to get noticed in the marketplace. With the extension of Entrepreneurs’ Relief in March 2016, and the introduction of Investors’ Relief, should true entrepreneurs be using Brexit as a springboard to success?

We explore the potential benefits…

Hitting the Ground Running

Whether the UK votes Leave or Remain on 23rd June 2016 [update: the people have spoken and we’ll be leaving], entrepreneurs who are able to roll with the punches and plan for any eventuality stand to achieve a competitive advantage as others scramble to adjust. It’s been repeatedly shown that periods of economic change and transition offer a window for innovative start-ups to get a head start – with their flexibility, innovation and drive helping them to thrive where more established, entrenched businesses may struggle to keep up.

Extension of Entrepreneurs’ Relief

Announced as part of the 2016 Budget, the extension of Entrepreneurs’ Relief is another big opportunity for many fledgling startups. According to the government, the goal of the extension is “to create a strong enterprise and investment culture, and ensure that companies can access the capital they need to expand and create jobs. Extending ER to external investors is intended to provide a financial incentive for individuals to invest in unlisted trading companies over the long term.”

With investment opportunities being made more tempting and more lucrative, savvy entrepreneurs should capitalise on more readily available sources of funding while more risk averse startups are sitting tight.

Introduction of Investors’ Relief

Another measure announced in the 2016 Budget was the introduction of Investors’ Relief to long-term, external investors in unlisted trading companies. The relief will offer a reduced rate of 10% Capital Gains Tax (CGT) on shares in unlisted companies purchased after 16th March 2016 – providing they’re held for a minimum of 3 years from 6th April 2016. The lifetime limit is £10m.

S/he Who Dares

So does Brexit present an opportunity or is the idea of taking a leap in the face of a Brexit too risky for fledgling businesses? For confident entrepreneurs who are ready to adapt and evolve their business model to deal with whatever the shifting business landscape throws at them, there may not be a better time to source investment.

Do you think Brexit presents an exciting opportunity for entrepreneurs? Please share your thoughts with us on our Facebook page.

At Parker Andrews, we work with business owners and sole traders, helping them to raise the capital investment they need to flourish. To find out more, please get in touch with our expert advisers today.