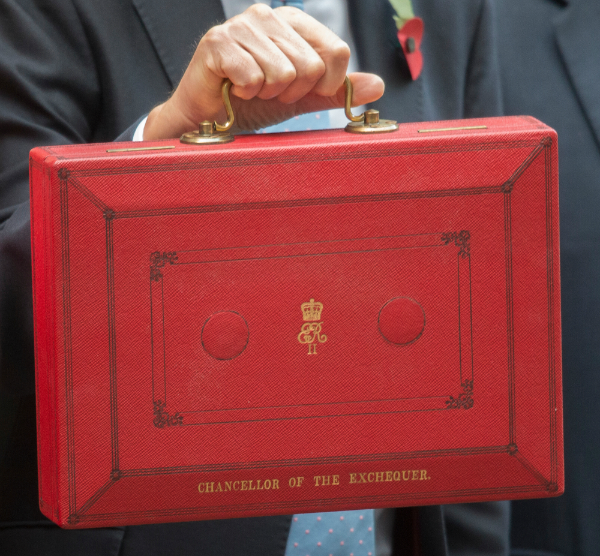

Will the Upcoming Election Change the Dynamics of Entrepreneurs’ Relief?

Political turmoil creates uncertainty and the fear for drastic changes being made in the event a new Government is elected. As so many current sitting MPs are due to stand down or retire, it is clear that the political direction of the country will change come Friday 13th December.

It is therefore prudent to expect a budget to be implemented at short notice, particularly given that due to the election, no budget was provided prior to the dissolution of parliament this year. We have no idea of who will form the next government and thus no idea on the future of any exit plans subject to the current rules and tax exemptions, so if you are considering retiring or selling your business then it may be an opportune time to take advantage before any changes are announced.

To this end, since the announcement of the general election, we have seen a number of enquiries from successful entrepreneurs who are concerned regarding the potential for tax benefits (such as Entrepreneurs’ Relief) to be radically altered. Some are seeking to liquidate their companies and extract any value in a tax-efficient manner (under the current rules) prior to the election, having been previously content to simply continue withdrawing dividends as part of retirement plans.

This may be food for thought for your high net worth clients or any owner-managed businesses considering their retirement/exit plans.

Please do not hesitate to get in touch if you have any clients who may wish to discuss our solvent liquidation services.

Find out more about our Members Voluntary Liquidation service today.