Corporate Insolvency Numbers Hit Five-Year High

The second quarter of 2019 saw the highest number of corporate insolvencies in England and Wales for more than five years.

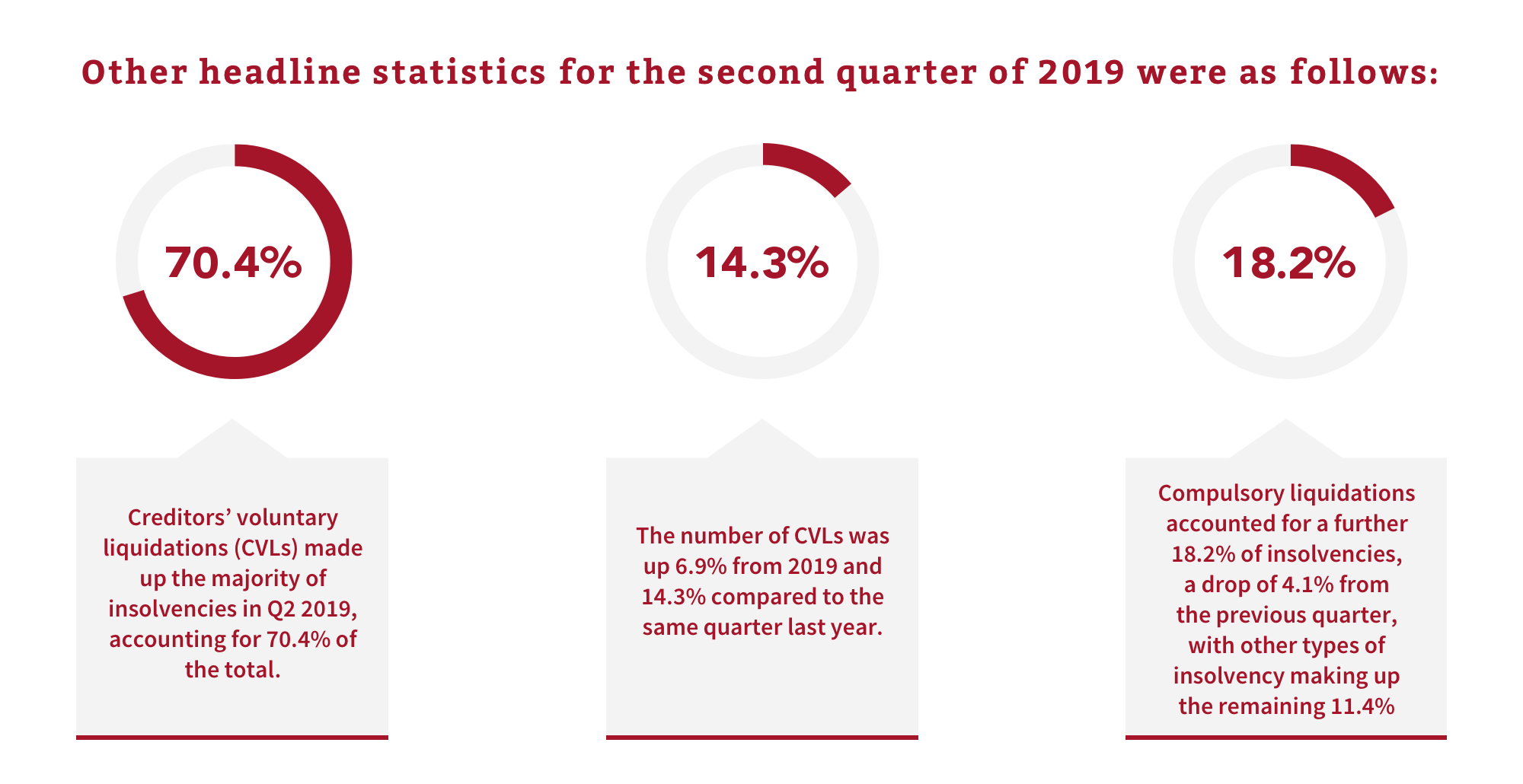

According to the latest figures from The Insolvency Service, 4,321 companies entered insolvency between April and June, a 2.6% increase on Q1 2019 and 11.9% higher than Q2 2018. Most notably, however, it marked the largest number of company insolvencies in any quarter since Q1 2014.

Administration Figures Remain High

There were 400 administrations in Q2 2019, an 11.4% drop from the 451 seen in the previous quarter. However, after Q1 2019, it was the second-highest number of administrations since Q1 2014 – and 15.2% higher than the second quarter of 2018.

In spite of this, administrations are less common than they were around the time of the financial crisis of 2008/09, peaking at 2,090 in Q4 2008.

Insolvency Numbers by Industry

On an industry level, the construction, accommodation and food sectors were the main drivers of a rise in corporate insolvencies in the 12 months ending Q2 2019. Excluding insolvencies where the industry was unknown, there were 97 extra underlying company insolvencies over the course of the year, 0.6% higher than the 12-month period ending Q1 2019.

- The accommodation and foodservice industry had 74 extra cases of insolvency compared to the 12 months ending Q1 2019 (an increase of 3.4%),

- The construction industry had 37 additional insolvencies (a 1.2% increase). With 3,100 insolvencies in the 12 months ending Q2 2019, construction continues to be the industry with the highest number of new company insolvencies (excluding bulk insolvencies).

Conversely, there were 53 fewer cases of insolvency among businesses operating in administrative and support services (down 2.8%), and 21 fewer cases in the transportation and storage industry (a fall of 3.9%).

The Reasons Behind the Increase

Insolvency professionals have cited Brexit and the continued rise of e-commerce as possible drivers for the rise in company insolvencies.

“Retailers are suffering as the world in which they operate changes and more and more people shop online,” said Duncan Swift, president of R3, the insolvency and restructuring trade body. “And businesses which stockpiled items ahead of the original Brexit deadline of 29 March will now be seeing those decisions have an impact on their cash flow levels.”

Personal insolvency numbers also remain high, with Insolvency Service figures revealing that 30,936 individuals entered either bankruptcy, a debt relief order or an individual voluntary arrangement (IVA) in Q2 2019 – the highest Q2 figure since 2010.

Although the numbers were down 1.3% from the previous quarter, further statistics reveal that 1 in 382 adults entered into a personal insolvency procedure in the rolling 12 months ending Q2 2019, a higher ratio than the 1 in 388 adults who entered one in the equivalent period ending Q1 2019.

If your business is having trouble with its cash flow, or you’re facing personal financial difficulties, the experts at Parker Andrews can help you find the right solution. Get in touch with one of our insolvency practitioners today.